Has Suzlon valuation gone too far?

Suzlon Energy's stock soars 304% in a year, but is the valuation sustainable? Look at Suzlon's impressive growth, sky-high P/E ratio, and potential risks in this in-depth analysis of India's wind power leader.

Suzlon Energy's stock has been on a wild ride, soaring to dizzying heights over the past year. As of August 16, 2024, stock price has topped ₹80.

But as the dust settles, some investors are starting to wonder if this renewable energy darling might be flying a little too close to the sun.

By the numbers:

- Market cap: A whopping ₹108,050 crores

- P/E ratio: A sky-high 117

- 1-year stock return: An eye-popping 304%

- 5-year stock price CAGR: A not-too-shabby 81%

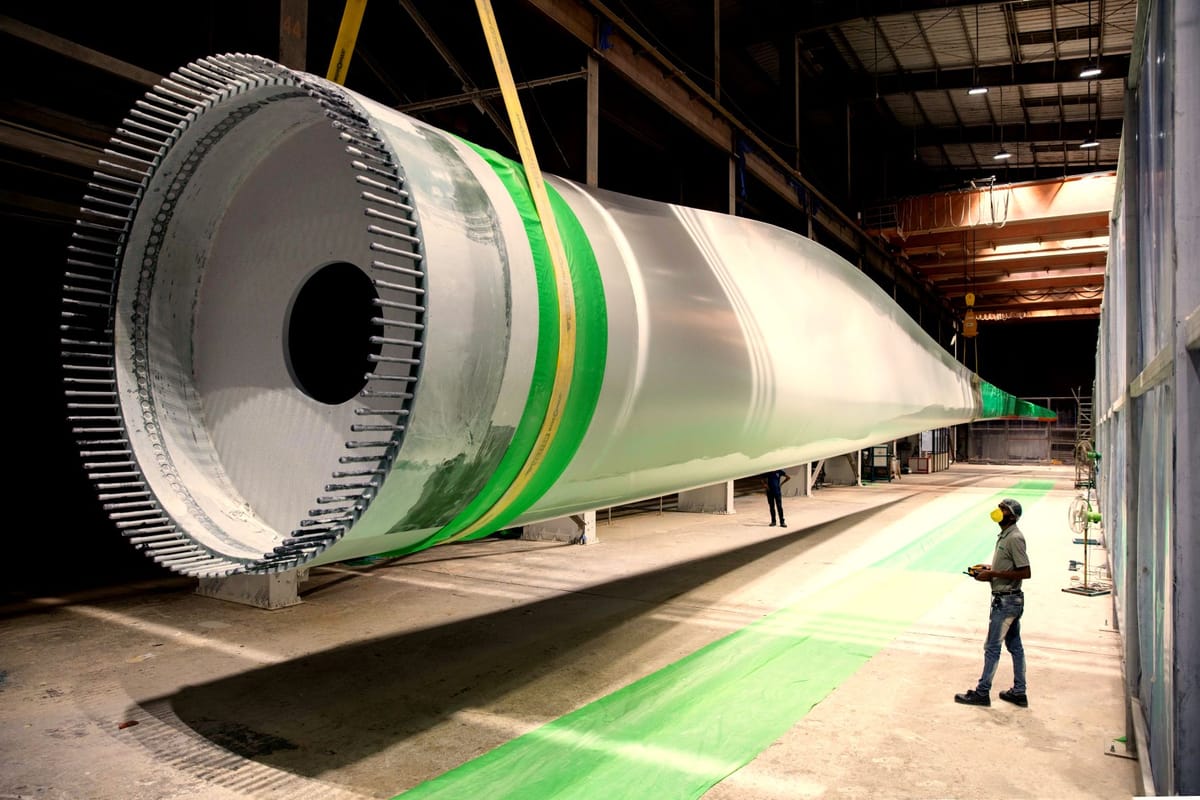

The big picture: Suzlon, once a poster child for India's renewable energy ambitions, has transformed lately from a debt-laden struggler to a market favorite. The company has been riding the green energy wave, with its turbines business seeing growing profits and investor excitement.

Fundamentals meanwhile is what keep hopes going. Suzlon recently dropped its Q1 FY25 results, and they were, quite frankly, a banger:

- Net profit tripled to ₹302 crores

- Revenue surged 50% to ₹2,016 crores

- EBITDA grew by a hefty 86% to ₹370 crores

The company's order book is bursting at the seams, sitting at a record 3.8 GW.

Why it matters: while the turnaround is cool, the question on everyone's mind is if this a sustainable uptrend or a bubble waiting to burst?

- The P/E ratio of 117 isn't just high; it's in the stratosphere compared to industry peers.

- The stock is trading at 27.5 times book value. In other words, you're paying ₹27.5 for every ₹1 of Suzlon's net assets.

- Promoter holding is at a rather uninspiring 13.3%, which has been shrinking over the past three years. Not exactly a vote of confidence seeing the folks running the show slowly backing away.

- Despite turning profitable, Suzlon is keeping all its cash to itself. No dividends.

Yes, but: hold on, say the bulls. There's method to this market madness:

- Renewable energy isn't just the future; it's the now. And Suzlon is perfectly positioned to ride this green wave.

- The company has gone from drowning in debt to sitting on a comfy cash pile. Talk about a glow-up!

- That massive order book? It's like a crystal ball showing years of future growth.

- Suzlon has tightened its belt and streamlined operations. It's leaner, meaner, and ready to turn those orders into cold, hard cash.

The bottomline: effective and successful comeback stories are not common in the markets. But at these nose-bleed valuations, there's little room for hiccups.

Zoom out: India's irreversible transition to cleaner energy sources to sustain its economic growth and population expansion, is what anchors valuations for its leaders. For the market perspective, it's also growing retail participation.